How we set our tariffs

All tariffs and charges in the FPS are governed by 3 key principles:

- Set by a competitive process where appropriate and otherwise economically justified

- Reflective of the nature of service being provided

- Representative of a fair balance between risk taken and return earned

The Components of the Tariff

The tariff has been built up from 4 key components that fully reflect the cost of developing and operating the Forties System:

- Historic Capital Investment

- Future Operating Costs

- Future Capital Costs

- Future Decommissioning Costs

Historic Capital Investment

The magnitude of the Historic Capital Investment component has been evaluated following Office of Fair Trading guidance that states 'it is justifiable to seek recompense for a historic investment (through tariff) where it can be shown that the investor has not yet recovered a reasonable return on that investment.' Investment in FPS can be categorised into three individual investment phases (as shown in the diagram below). To fairly evaluate the return of the system each investment decision has been evaluated independently.

The £200m initial investment in the FPS in the 1970's was made primarily to export Forties Field oil production. As this investment was never expected to be recompensed by 3rd party tariff revenue it has been excluded from the historic capital investment component of the tariff.

The second £1bn investment phase in the early 1990's was made to expand the capacity of FPS in order to win additional 3rd party business. This investment was over and above that required to provide continued service to existing customers and did not have the security of guaranteed future volumes or revenue.

The profitability of the £1bn investment was accessed by comparing the cost of capital of the project at the time of inception with the actual return achieved from business subsequently won (post '93).

A third tranche of investment was made in the mid 2010's to comply with environmental legislation to ensure future system longevity. Further investment for the first half of the 2020's shall enable FPS to continue to provide services out to 2040 and beyond.

The return associated with investment (to meet the cost of capital) is built into the standard tariff which is payable by new customers. The revenue required to meet the cost of capital has been assumed to be shared equally amongst all past and/or expected future barrels, as appropriate.

The ability to meet the cost of capital over the full life of the system may be inhibited by the ability to manage future risks such as:

- Safety & Integrity

- Environmental Legislation

- Rising Costs

- Reducing Throughputs

- Decommissioning

These factors remain as significant risks for INEOS.

Future Operating and Capital Costs

INEOS are investing significant sums in FPS to maintain availability and integrity. The future operating and capital cost components have been estimated to evaluate the future cost of operating the system up to 2040 and then have been averaged across all forecast barrels.

Decommissioning Costs

In a similar manner, the total cost of decommissioning FPS System has been shared equally amongst all past and expected future barrels.

In the event that additional treatment is required (e.g. if fluids do not meet standard specification) the transportation tariff shall be amended accordingly to reflect the cost of providing such additional services.

INEOS' Operating Cost Option

The standard form FPS Transportation and Processing Agreement (TPA) contains an option for INEOS to switch customers from a tariff-based charge to a cost-share based charge. Where costs exceed the tariff value, this leads to a requirement to operate the cost-share provisions of TPA. In very simple terms, the switch from tariff to paying a (throughput related) share of FPS operating costs, and (reserves based) share of FPS capital costs, occurs at the point where received income no longer renumerates the cost of providing the service.

INEOS appreciates that FPS customers would like to understand if and when INEOS is likely to exercise this option. The predominant factors which will influence INEOS' decision for onset of cost-share in FPS are long term system throughput, each entrant's utilisation of the FPS facilities and their current tariff. Clearly this will be dynamic, involving variables out-with INEOS direct control or influence. Nevertheless, we will be open and honest in our discussions with customers as to a range of potential dates for the onset of cost-share. Further information can be found in the information note provided by clicking on the link below.

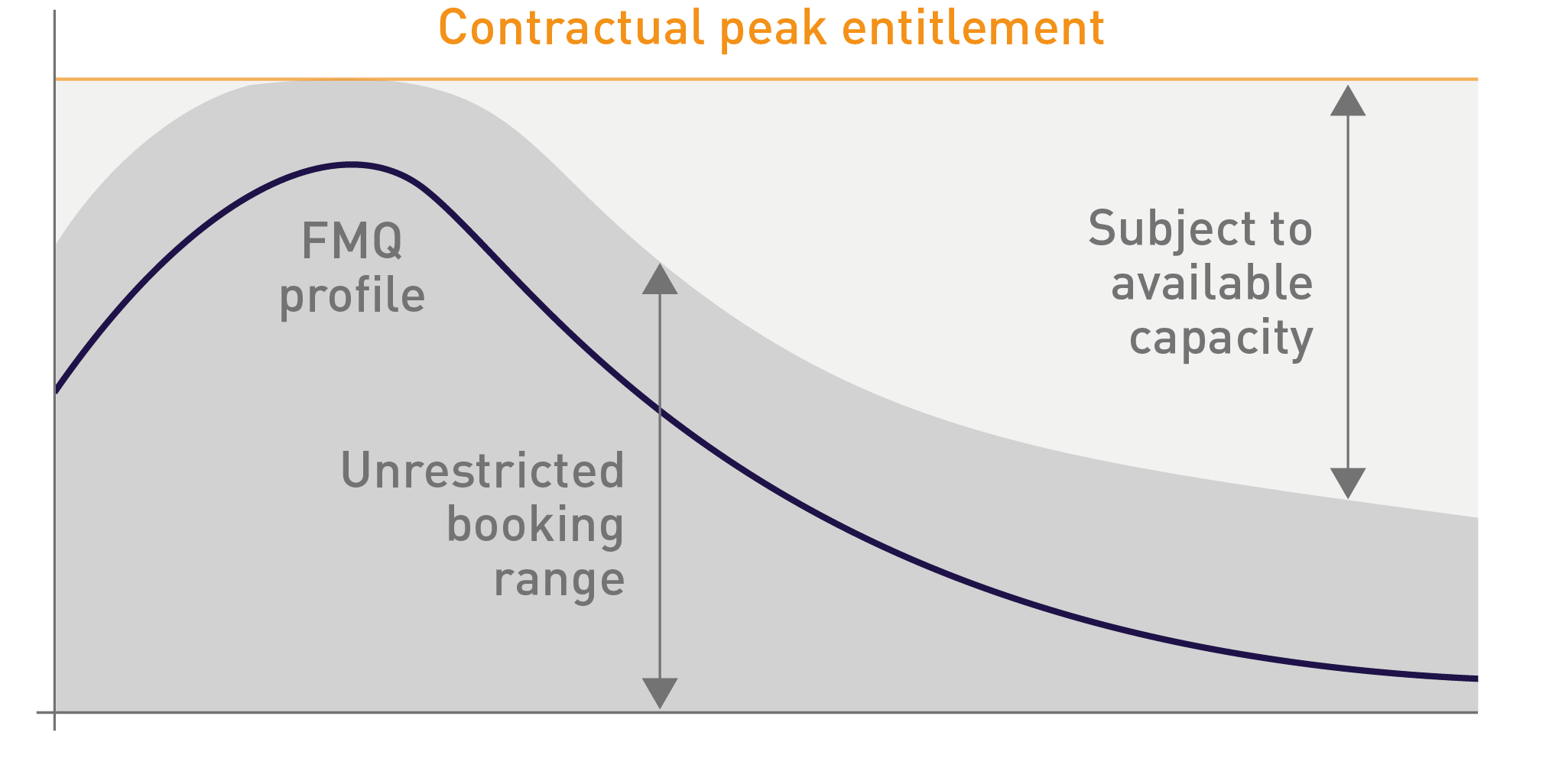

NB: The Unrestricted Booking Range only applies to fields with maximum production of less than 30 mbd.

NB: The Unrestricted Booking Range only applies to fields with maximum production of less than 30 mbd.